Managing business finances is critical to ensuring your company’s success and stability. Among the various financial management tasks, cash flow forecasting is a powerful tool for planning, making informed decisions, and avoiding cash flow crisis. Are you ready to master your business finances with an effective cash flow forecast strategy? Let’s dive deep into the world of cash flow forecasting and explore how to create accurate and reliable cash flow projections.

Key Takeaways

- Decode cash flow forecasting by understanding the inflow and outflow of cash.

- Cash flow forecasts are essential for businesses to monitor finances, plan investments, and maintain financial stability.

- Establish goals and select a forecast period and method. Estimate future sales/receipts and payments. Analyse historical data and trends to enhance projection accuracy.

Decoding Cash Flow Forecasting

Cash flow forecasting estimates future cash inflows and outflows using past business performance data and known / estimated future cash flows. Understanding your business’s cash inflows and outflows paves the way for wise decision-making and proactively avoiding cash flow issues.. Let’s explore the fundamentals of cash flow forecasting and its importance in managing your business finances, including the ability to forecast cash flow.

To produce a cash flow forecast, you will need to:

- Start with an initial bank balance.

- Estimate future sales and expenses.

- Calculate the difference between the anticipated receipts and the estimated expenditures to determine the cash flow projection for the period you are forecasting for.

Given the appropriate tools and strategy, generating a future cash flow projection usually takes under an hour.

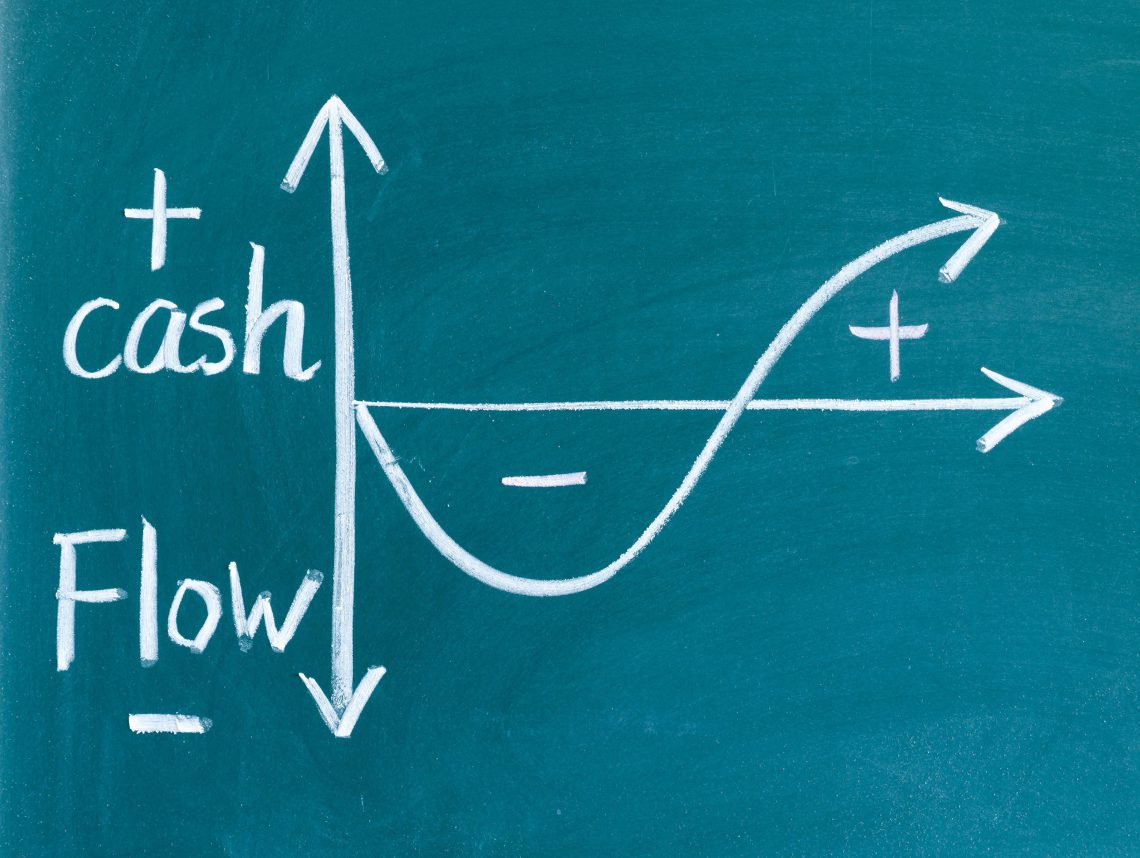

Understanding Cash Flow: Inflows and Outflows

Cash flow is essentially the movement (inflow and outflow) of actual cash flows. Comprehending these aspects is vital for productive forecasting. Operating business cash flow, which comprises money obtained from customers and cash spent to cover operating expenses, indicates whether a company is financially sound and generating cash from its primary operations.

Cash inflows can come from various sources aside from sales. On the other hand, cash outflows are the expenses your business incurs, such as operating costs, interest payments, and raw materials. Understanding cash inflow and outflow intricacies is key to crafting a complete and precise cash flow forecast.

The Role of Cash Flow Forecasting in Business Finances

Cash flow forecasting has a pivotal role in business finances, assisting in pinpointing possible shortfalls, planning investments, and making knowledgeable decisions. For startups, cash flow forecasting is particularly crucial for monitoring finances and burn rate, and preparing for situations that require additional cash.

The benefits of cash flow forecasting extend to businesses of all sizes, as it helps them avoid cash deficiencies and capitalise on any cash excesses. Maintaining realism during cash flow forecasting is key to ensuring the projection’s accuracy. Based on cash flow predictions, businesses should make appropriate financial adjustments to maintain liquidity and financial stability, as well as plan for the use of excess cash.

Setting Up Your Cash Flow Forecast

Setting up a cash flow forecast requires defining your goals, choosing a suitable forecast period, and deciding on direct or indirect forecasting methods. Each step is critical to creating a tailored cash flow forecast that supports your business objectives and helps you plan for the future.

Establishing Your Forecasting Goals

Defining your forecasting goals is the first step in creating a customised cash flow forecast aligned with your business objectives. Cash flow forecasting goals may include:

- Short-term liquidity planning

- Debt reduction

- Risk management

- Growth planning

Your business type can significantly impact your cash flow forecasting objectives. Seasonal businesses, service-based businesses, and product-based businesses may have different cash flow trends and cycles, which affect the accuracy and timing of cash flow forecasts. Comprehending these elements is vital for establishing practical cash flow forecasting goals and guaranteeing sufficient cash reserves for short-term financial obligations.

Selecting the Forecast Period

The forecast period significantly influences the accuracy and reliability of your cash flow forecast, with different periods recommended for various business goals. For well-established businesses, monthly or quarterly forecasts are typically recommended. In contrast, businesses experiencing significant growth or changes, such as reorganisation or mergers/acquisitions, may benefit from weekly cash flow estimates.

If you’re starting, a 13-week cash flow forecast is advisable.

For all businesses a 12-month rolling forecast is the ultimate cash flow forecasting tool. Why is this? Because usually the largest frequency for items is annual. – such as insurance premiums With a 12-month rolling forecast, you won’t miss a thing.

Choosing Between Direct and Indirect Forecasting Methods

When it comes to cash flow forecasting, you can choose between direct and indirect methods. The direct method is recommended for daily cash management and has a maximum forecast period of 90 days. It involves analysing anticipated transactions, completing short-term cash flow forecasts, and being aware of the flow.

On the other hand, the indirect method is typically used for long-term, high-level strategy decisions. Comprehending the benefits and drawbacks of each method allows you to decide upon the most suitable approach for your business needs and guarantee an extremely precise cash flow forecast.

Crafting a Detailed Cash Flow Projection

A detailed cash flow projection involves:

- Estimating future sales and cash receipts.

- Planning for expected cash payments.

- Calculating net cash flow.

Considering all these aspects, you can craft a complete and precise cash flow forecast, aiding in superior business finance management and future planning.

Estimating Future Sales and Cash Receipts

To estimate future sales and cash receipts, you’ll need to analyse various factors, including historical data, market trends, and other relevant information. This analysis will yield useful information about your business’s past performance, customer behaviour, and key sales drivers.

Market trends can significantly influence your business’s future cash receipts. By staying informed about market conditions and expert analysis, you can adjust your sales strategies, pricing models, and product offerings to better align with market demands. This will help you attract more customers, boost sales, and ultimately increase your cash receipts.

Planning for Expected Cash Payments

Planning for expected cash payments requires thoroughly understanding your business expenses and potential liabilities. To accurately estimate expected cash payments for cash flow forecasting, you should gather data on anticipated expenses such as:

- operating costs

- loan repayments

- taxes

- other regular payments related to your business operations.

Reviewing past business performance, sales history, and expenses enables accurate future cash outflow estimates and future cash position predictions. Precise cash flow forecasting assists companies in avoiding cash shortages and making wise financial decisions.

Calculating Net Cash Flow

Calculating net cash flow involves the following steps:

- Subtract estimated cash outflows from estimated cash inflows.

- This will provide a clear picture of your business’s financial health, including any potential negative cash flow.

- This calculation offers valuable insights into your company’s cash position, financial performance, and net cash flows.

- It helps you make informed decisions and plan for the future.

Analysing and understanding your historical cash flow statement can help you identify trends, assess liquidity, and plan for necessary adjustments to ensure a steady cash flow. By regularly calculating your net cash flow, you can stay on top of your finances and adjust as needed to maintain your business’s financial stability. This information will form the basis of your forecast.

Leveraging Technology for Accurate Cash Flow Forecasts

Technology can streamline cash flow forecasting by integrating accounting systems and offering sharing and collaboration features. Utilising technology allows for the creation of more accurate and dependable cash flow forecasts, guaranteeing superior financial planning and decision-making for your business.

Integration with Accounting Systems

Integrating your cash flow forecasting tool with accounting systems ensures accurate and up-to-date financial data for your cash flow forecast. Synchronising with accounting software like QuickBooks, Xero, or MYOB allows cash flow forecasting software to pull data directly from these systems, ensuring forecasts and statements are based on real-time financial information.

Automating data transfers and reducing manual data entry needs through system integration offers several benefits:

- Saves time and effort

- Decreases the risk of errors

- Improves the overall accuracy of cash flow forecasts

- It allows you to make better financial decisions for your business.

Sharing and Collaboration Features

Sharing and collaboration features are vital for successful cash flow forecasting. They enable smooth communication and decision-making among team members and clients. Incorporating sharing and collaboration features into your cash flow forecasting process can improve precision, reliability, and communication among stakeholders.

Cube Software and Cashflow Frog are examples of cash flow forecasting tools with robust sharing and collaboration capabilities. By using these software tools, you can create a more collaborative and efficient cash flow forecasting process, ensuring the best possible financial outcomes for your business.

Analysing and Interpreting Your Cash Flow Forecast

Analysing and interpreting your cash flow forecast involves reviewing projections against actuals and taking action based on predictions. Regularly evaluating your cash flow forecast allows you to identify discrepancies, make necessary adjustments, and enhance future projection accuracy.

Reviewing Cash Flow Projections Against Actuals

Regularly reviewing cash flow projections against actuals can help you:

- Identify discrepancies

- Improve forecast accuracy

- Make adjustments

- Enhance the precision of your future projections

CashFlowMapper is an example of a tool that can help you:

- Compare cash flow projections with actuals

- Identify areas where you can improve your cash flow forecasting

- Optimise your financial planning

- Better prepare for future financial challenges.

- Easily prepare rolling forecasts, the most useful and powerful business planning tool there is.

Taking Action Based on Cash Flow Predictions

Action based on cash flow predictions can include adjusting expenses, increasing sales efforts, or seeking additional financing. Analysing cash flow forecasts and making knowledgeable decisions aids in better business financial health management and guarantees consistent cash flow.

For example, if your cash flow forecast predicts a cash shortfall in the coming months, you might consider cutting costs, increasing marketing efforts to boost sales, or applying for a loan to cover the gap. By taking action based on your cash flow forecast example, you can proactively address potential financial challenges and maintain your business’s financial stability.

Similarly, if your forecast shows the generation of excess cash, you can start to plan how to best utilise it; more staff, more equipment, acquisitions, and reducing liabilities are some options.

Enhancing Forecast Accuracy with Historical Data

Enhancing forecast accuracy with historical data involves:

- Learning from previous forecasts

- Adjusting for seasonal variations and market trends

- Analysing historical data

- Integrating past trends

This creates more accurate and dependable cash flow projections that reflect your business’s positive cash flow situation.

Learning from Previous Forecasts

Analysing past forecasts can reveal patterns and areas for improvement, leading to more accurate future projections. Examining past forecasts and identifying trends provides useful insights into your business’s cash flow patterns and allows for necessary adjustments to enhance future forecast accuracy.

Understanding the factors that contributed to discrepancies between past forecasts and actual results can help you refine your cash flow forecasting process and make more accurate predictions in the future. Learning from past forecasts improves your cash flow projections’ overall accuracy and reliability.

Adjusting for Seasonal Variations and Market Trends

Adjusting for seasonal variations and market trends ensures your cash flow forecast remains relevant and reliable in a constantly changing business environment. To adjust your cash flow forecast for seasonal variations, gather historical data, analyse recurring patterns, and make projections based on historical trends. This will help you better prepare for seasonal variations in your business and maintain a steady cash flow.

Market trends can significantly influence cash flow forecasting. Keeping informed about industry trends and competitive dynamics enables anticipation of shifts in customer demand, pricing, and market conditions. Incorporating market trends into your cash flow forecast can help you make more accurate predictions and optimise your financial planning.

Summary

Mastering your business finances with an effective cash flow forecast strategy is essential for maintaining financial stability and planning for the future. By understanding the fundamentals of cash flow forecasting, setting up your cash flow forecast, crafting detailed projections, leveraging technology, analysing and interpreting your forecast, and enhancing forecast accuracy with historical data, you can make better decisions to manage your business’s financial health. Embrace the power of cash flow forecasting and unlock your business’s potential for financial success.

Frequently Asked Questions

How to calculate the cash flow forecast?

To calculate a cash flow forecast, one should begin by calculating operating cash flow, then adding change in working capital. Finally, add beginning cash to projected inflows and subtract projected outflows to determine the ending cash balance.

What is a cash flow forecast for a small business?

Cash flow forecasting is the understanding and method used to predict cash inflows and outflows ultimately helping identify future cash needs. It involves estimating future sales and expenses, which will provide insight into whether or not the business has enough income to cover expenses, prevent cash shortages, and plan for growth.

What is the significance of cash flow forecasting in business finances?

Cash flow forecasting is a powerful and essential tool for any business, allowing them to accurately anticipate and prepare for potential deficits, arrange investments, and make informed decisions.

How can historical data improve the accuracy of cash flow forecasts?

Historical data can be analysed and leveraged to understand and identify trends, seasonality, and patterns in cash flow, providing a reliable basis for more accurate cash flow forecasts.