Introduction

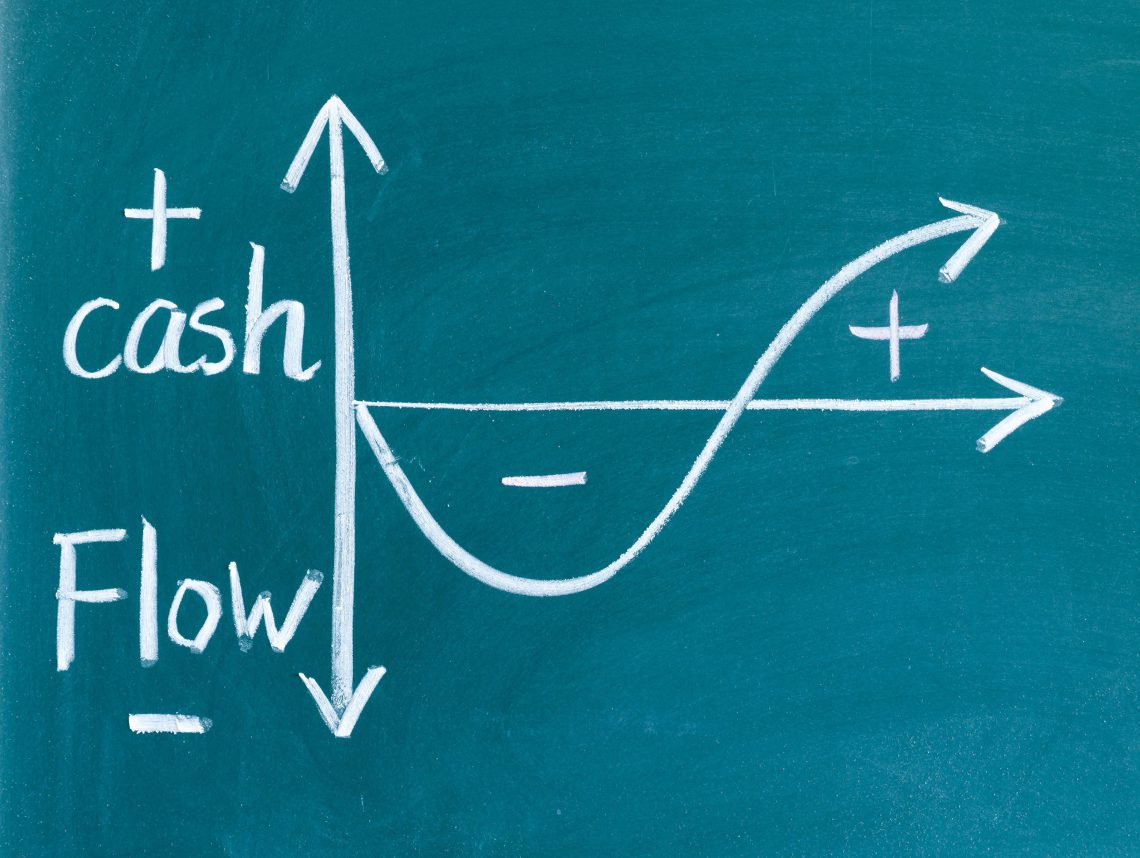

Forecasting (determining where we are actually going/our expectations) is related to budgeting (planning where we want to go/our intentions). Both are future-focused and essential parts of business management and control.

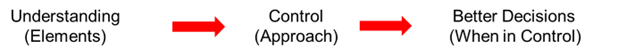

Below is an approach to follow, along with considerations you should take into account when forecasting cash flow. There are 6 elements to cash flow forecasting, and they are all important.

1. Start with what you know

- 1. Transactions – Short Term: Fixed Costs & Regular Outgoings

- Regular payments: typical items will be rent, insurance utilities & other creditors

- Consider payment terms of various suppliers

- Payroll Components: net pays, PAYG, payroll tax, superannuation, workers’ compensation

- Taxes & other regulatory costs: payroll, income, GST, and rates

- The above gives you a base.

-

- This will give you the outflows your inflows need to cover and help you determine your minimum cash on hand, or “2. Comfort Level” of cash, which will be the number of months’ worth of operating cash outflows, depending on the volatility of your business or industry.

2. The more difficult parts

- 1. Transactions – Short Term: Revenue Inflows

-

- Be realistic with forecasting growth or the addition of new inflow streams.

- Factor in typical payment terms based on past behaviour, industry standards, & credit check indications.

- 1. Transactions – Short Term: Associated Variable Costs

-

- These are incurred only when revenue-generating events occur, so be aware of any relationship among these items. An example would be delivery costs incurred in distributing a sold item to a customer.

3. Remember to consider behaviours

- 3. Recurrence (one-off, indefinite, to a certain date, number of recurrences).

- 4. Frequency (daily, weekly, fortnightly, monthly, quarterly, half-yearly, annually).

-

- Start & end dates of transactions (transactions may not span the entirety of your forecasting period).

- Inflation factors (often a part of lease contracts for example).

- 5. Timing of transactions is crucial. Ensure you know the impacts of various scenarios, particularly of differing customer payment behaviour and variable costs.

4. The results of the above impact on:

- 6. Transactions – Long Term: Once the first five elements have been understood, then you’ll know about:

-

- Your ability to service loans, pay dividends, purchase assets / expand, or

- Your requirement to take on loans or equity.

5 Cash Flow Planning Approach

5.1 Timeframes

- Short Term – more accurate (less speculative) than Long Term Forecasts

-

- Weekly, monthly, and quarterly. This lets you keep on top of current and known/expected events. Knowing movements on a daily basis is the best and most detailed way to plan cash flows.

- Rolling 12-month forecasts. Most recurring transactions have at most a 12-month cycle – annual income tax, workers’ compensation & insurance, for example. Most also have a half-yearly or quarterly cycle, such as tax instalments. With a rolling 12-month forecast, you’ll always have these transactions allowed for – you can’t afford to miss them!

- Consider payables and receivables on an individual basis and the impact of changes to expected payment/receipt dates.

- Long Term

-

- 12-month forecasts in line with your budgeting cycle. Remember that profit and cash are two different things.

- 3 – 5 year forecasts. These give an idea of when big (long-term) transactions can take place (both cash surpluses and deficits), so you can prepare for these and make adjustments to your activities accordingly.

5.2 Other Things to Consider

- Scenarios

-

- At the very least, plan around “Expected,” “Best-Case,” and “Worst-Case” scenarios. You need to see the variability around your business and what factors influence this, particularly around customer/client receipts.

- Start with your “Expected Case,” and use that plan as a basis for the other scenarios. “Expected Case” is simply what you honestly think will happen and why.

- Business Unit Planning

-

- Break your business up into units so that you can track the performance of each:

-

-

- Project

- Site / Store / Division

- Bank Account

-

-

- Consolidate/merge these into an overall plan; you need to see the big picture as well as its components.

- Compare to Actuals

-

- Just like comparing actual to budgeted profit & loss, do the same for cash flow. This will tell you the parts of your business that have the biggest impact on cash flow and those that are the most susceptible to changing conditions.

- Comparing actual to budget will tell you where you are tracking well and where the gaps are.

- Culture – considering the cash flow effects of transactions must be a part of your business!

6 Maintain the Discipline – Constantly Review!

If there’s one thing you must stay on top of, it’s cash flow movements. No cash – no business!

CashFlowMapper is a cloud-based cashflow forecasting tool designed so you can understand and take control of your most important asset – cash!

Ideal for advisors, business owners, or finance professionals.