The financial pulse of any business lies in its cash flow – the movement of money in and out of the enterprise. How effectively this pulse beats determines the company’s liquidity and overall financial health. But how do businesses ensure a steady rhythm? The answer lies in mastering cash flow forecasting, a strategic tool that provides a useful insight into a company’s future financial condition.

Key Takeaways

- Cash flow forecasting is a critical exercise that predicts a business’s cash inflow and outflow, vital for maintaining operations and financial health and predicting possible financial challenges.

- A comprehensive cash flow forecast involves careful examination of cash inflows from operations, investments, and financing activities, anticipating fixed and variable cash outflows, and accurately calculating net cash flow to support decision-making and growth.

- Implementing cash flow forecasting tools, like CashFlowMapper, can offer automation, integrate with existing financial systems, and enhance collaborative efforts within teams to maintain financial wellbeing and proactive management.

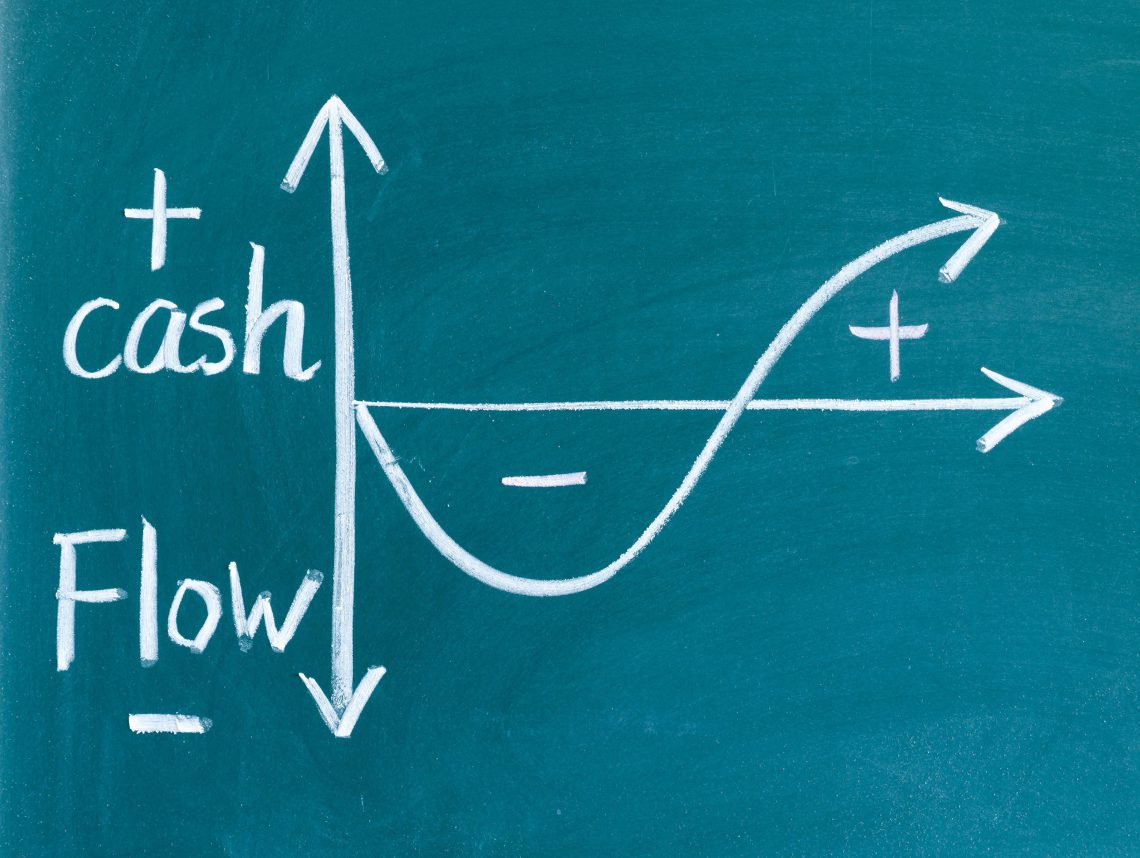

Understanding the Basics of Cash Flow

The exchange of money into and out of a business is what we call cash flow, which plays an important role in keeping the organisation’s liquidity and financial stability. It can be compared to a river flowing into a lake, with the former representing incoming funds. At the same time, the latter symbolises its utilisation for continued operations and growth prospects. This necessitates cash flow forecasting so businesses have sufficient monetary resources available at all times, even when their outgoing expenses exceed inflow amounts from different sources. By accurately predicting this movement over time, companies can identify any ‘storms’ or sudden influxes/outflows they may face before it happens- not unlike how meteorologists forecast changing weather patterns beforehand.

The Essentials of Crafting a Cash Flow Forecast

Forecasting cash flow is similar to putting together a puzzle – it involves recognising the money coming in, predicting the funds leaving and determining net cash flow. All elements are integral for constructing an overall picture of a firm’s expected financial situation, making it vital to correctly predict its cash flow.

Identifying Your Cash Inflows

Cash flow is an essential part of any business, and forecasting it properly begins with acknowledging the opening cash balance along with its various sources of income – sales, asset sales, rebates or grants. These inflows directly affect the net cash flows for businesses as they contribute to their ability to meet expenses and expand operations. It’s important that these estimations be accurate, so predicting such inflows should factor into upcoming plans/goals & current market conditions, including new competitors’ impact on revenue from product/service sales gained through investing activities like loan funding or equity injections, etc. Such considerations prove vital when calculating overall inflow accuracy, thus facilitating effective long-term management of any given Cash Balance.

Anticipating Your Cash Outflows

Once inflows have been identified, predicting cash outflows is the next step. This involves a variety of business spending such as employee salaries, dividends to shareholders and reinvestment in the company, rent on office space, and general overhead costs not directly related to product manufacturing or sales. Much like streams leaving a lake, which lowers its water level, these outlays must be carefully handled to not exceed available funds. Therefore, keeping an ideal balance sheet.

These expenses can be categorised into fixed & variable ones. The former is payments regardless of revenue (e.g., salary), while the latter is contingent upon output (such as raw materials). Careful study and review of past transactions must ensure annual/irregular demands, e.g., tax dues, are met without any unpleasant surprises, allowing companies reliable management over their monetary status and steering away from fiscal difficulties down the line.

Establishing Net Cash Flow

Having a clear understanding of the actual money flow is important. Net Cash Flow that is, Total Incoming Money minus All Outgoing Money, must be positive over the long term, otherwise you have no business!

Companies must assess accurate insights about net inflows and outflows to ensure long-term success and progress planning even during uncertain times or climates, given global changes today.

The Significance of Accurate Cash Flow Projections

Having a precise cash flow forecast is imperative. Without an accurate map, navigating can be difficult, with many unexpected challenges along the way; similarly, inaccurate financial projections could lead businesses into turmoil. Accurate forecasts for cash flow are needed to predict future positions, prevent any damaging shortfalls in funds, and wisely maximise returns from extra money available within the organisation.

Close tracking of inflows and outflows will help companies such as those that lack capital maintain smooth running operations by ensuring they make payments appropriately, including settling bills owed to vendors/employees, covering taxes due or repayment plans made with creditors, etc. Correct predictions concerning their cash movements through effective forecasting tactics allow them to control liquidity while also making informed decisions related to investments that may arise from surplus finances.

Direct vs. Indirect Forecasting Methods

When it comes to cash flow forecasting, two main approaches can be taken: direct and indirect techniques. Just as different tools come in handy for specific tasks in a toolbox, each method offers its advantages depending on what your business needs and goals entail.

The direct approach leverages real-time transaction data with maximum accuracy over short periods. Thus making this method ideal if you require up-to-date information regarding current cash flows. This procedure may take longer than expected due to managing large transactions, but its trustworthiness compensates for any difficulties encountered. It is precise and can give daily cash movements if you require.

Indirect forecasting involves starting with a calculated net profit figure and adjusting for non-cash items such as depreciation and amortisation, as well as non-profit items such as capital purchases or sales. It can give you a reasonable high-level estimate of cash movements but does not have the precision or detail required to make decisions.

Implementing Cash Flow Forecasting Tools

Optimising the cash flow forecasting process is paramount for businesses, and tools such as CashFlowMapper can help with this. Like a GPS navigating your journey, these forecasting tools guide organisations to manage their money flows effectively.

CashFlowMapper provides features including automated rolling forecasts, consumption tax mapping, foreign exchange rates monitoring and quick reporting, and integration capabilities with accounting applications. This tool streamlines the entire process of predicting inflows/outflows so that transactions are precisely planned based on up-to-date information.

The user interface of CashFlowMapper enables users to generate immediate reports that they will have no trouble understanding while ensuring accuracy & timeliness related to all data regarding cash movements day by day.

Collaborative Forecasting with Team Collaboration Features

Businesses need to take advantage of cash flow forecasting to ensure their financial wellbeing. CashFlowMapper offers a collaborative feature that allows the team members to keep track of and monitor their preferred level of cash (as set by you) when it comes to the cash balance. The users can use the online reports to determine when the business is approaching this threshold, which enables them to tackle potential issues promptly, such as modifying spending habits or pursuing overdue payments. They can explore additional financing options while simultaneously being informed about real-time changes within the company’s finances using reports provided by this software – all leading towards an effective management approach for better results on a long-term basis with regard to business success.

Real-World Applications: Cash Flow Forecast

To understand the significance of cash flow forecasting, let’s look at its practical applications in businesses. Just like learning a new language involves seeing how it is used in everyday life, recognising the effects that cash flow forecasting can have on various-sized companies helps us better grasp why it’s so important and beneficial to them.

Small enterprises typically use spreadsheet templates to project past performance to assess future inflows and outflows related to money matters. Huge corporations regularly use different calculative tools to plan when gauging their need for upcoming capital requirements. At the same time, start-ups also rely heavily on this approach. As far as manufacturing goes, precisely estimating potential expenditure via predictable incoming/outgoing payments allows firms within such markets to ensure sufficient resources will be readily available whilst avoiding overstretching finance-wise ahead of fulfilling output demands satisfactorily.

Navigating Challenges in the Forecasting Process

Navigating the challenges of cash flow forecasting is crucial to guarantee its success and accuracy. Like vessels traversing turbulent waters, businesses must understand these difficulties to travel their financial journey effectively.

Primary issues associated with this process are time-consuming tasks, inconsistent numbers, and data overloads, leading to inaccurate forecasts. Dispersed information sources across departments that don’t receive enough attention or leave room for misjudgments concerning earnings projections come into play, too.

There are solutions available, such as contrasting actual results against calculated amounts and exploiting past performance figures to detect trends regarding future finance flows. Maintaining clear communication between teams involved in predictive modelling processes and being aware of not confusing profits with income streams when studying estimates, etc., allows organisations’ management to have accurate expectations about how money will be utilised once they receive it.

Automation advancements also help alleviate manual labour-related efforts resulting from traditionally consolidated reports systems, eventually decreasing long, tedious activities while delivering more precise outcomes over short periods necessary before making key decisions related to capital funds availability.

Leveraging Business Alerts for Proactive Management

Cash flow forecasting with business alerts offers businesses an invaluable early warning system, helping them proactively prepare and manage their cash. CashFlowMapper’s solutions provide tailored reports which can be used by financial managers to warn of any potential issues regarding the state of finances within a company. Such pertinent information could include changes to expected expenses, sudden fluctuations in cash flows, or signs pointing towards gaps appearing soon if not addressed promptly.

By utilising the reports generated by good quality forecasting platforms such as CashFlowMapper’s services, companies can make sure they remain up-to-date on how best to handle both long-term financing problems and opportunities should they arise, allowing smoother operation during more difficult economic times while also giving rise to expansion plans being pursued whenever possible under desirable situations too!

Then, utilising adequate alert systems facilitated through properly crafted forecasts is absolutely essential for entrepreneurs aiming at making sound investment decisions which will impact their resources today as well as tomorrow while minimising risks associated with it all the same time, ultimately leading entire corporations down successful paths in the future without intervention needed from external entities along those lines either!

Optimising Financial Planning with Scenario Mapping

When it comes to cash flow planning, uncertainty is an unavoidable factor. To prepare for whatever may come in the future, businesses can utilise scenario mapping through CashFlowMapper as a tool that allows them to analyse various scenarios and their respective outcomes. Scenarios will involve gaining / losing customers, increasing / reducing costs, fluctuating inflation and exchange rates, as well as changing the timing of these things.

A wide range of data points should be taken into consideration when creating these projections: past information about performance history or market trends, industry benchmarks and expert opinions – all this feeds into building accurate predictions that allow companies to navigate unforeseen difficulties with more confidence thanks to such precise analysis of possible variables involved in decision-making processes along the way.

All those plans created from scenario mapping can be compared simultaneously in graphical format. A budgeted cash flow forecast will form one of the scenarios. Typically, a base or expected case is created along with best and worst-case scenarios.

Benefits of Automated Cash Flow Analysis

Cash flow analysis has been drastically improved by automation, allowing businesses to reap the rewards of time efficiency, accuracy and insight. It’s like having an autonomous car that drives you where you need to go, all while sitting comfortably.

Automated cash flow forecasting ensures a standardised process with less manual input, thus reducing errors in estimates. Resulting in reliable financial planning. Benefits include minimised potential for human error and increased visibility into important transactions at any given point, which helps scale up operations more easily over time. To get maximum benefit from automated solutions, it is essential to streamline the above-mentioned steps properly, including eliminating risks associated with overlooking information, as well as systematically generating balance sheets/income statements pertinent to the growth and stability requirements of a business.

Cash Flow Management Tips for Sustained Growth

Cash flow management is an essential part of any business’s continuous expansion, much like a captain keeps their ship on course and avoids potential hazards. To successfully steer this financial journey, there are several tips that can help promote effective cash flow control.

First, analysing past forecasts to evaluate the accuracy and recognise discrepancies between estimates will provide valuable insight for future planning endeavours. Monitoring performance regularly supports the detection of issues before they become too severe or negatively impact working capital access. Secondly, updating forecasts when needed plays a role in monetary decision-making while helping identify potential deficits, enabling Resource distribution optimisation where required, which ultimately aids advancement opportunities for companies, big or small. Other strategies include improving accounts receivable records by decreasing liabilities as well as having efficient asset measures alongside maintaining backup bank funds just in case prices rise higher than anticipated plus speeding up payments with incentives available if received earlier than expected whilst establishing a separate account from general costs related to operating expenses as well collecting invoices fastidiously should not be neglected either! Thus, it’s clear managing one’s cash properly through such methods makes all the difference in ensuring stability over time so businesses stay afloat, grow rapidly and move forward!

Summary

Cash flow forecasting is important for the financial health of businesses, which can be achieved by familiarising yourself with the basics and employing more advanced tools such as CashFlowMapper. By understanding cash inflows and outflows, monitoring net cash flows closely, and utilising suitable strategies to manage money properly, companies are better positioned to weather any turbulence on their fiscal journey while safeguarding the progress made so far.

Frequently Asked Questions

How do you calculate forecasted cash flow?

The cash flow forecast formula can be used to work out the projected funds available: Start with your existing cash, then add estimated Inflows and subtract anticipated Outflows, which will result in an Ending Cash amount.

What is a rolling 12-month cash flow forecast?

A 12-month rolling cash flow forecast helps start-ups and established companies plan their future liquidity needs by providing an outlook of expected income and expenses over the coming year. It is crucial to assess available financial resources to ensure there will be enough money at hand when needed. Why 12 months? Because annual transactions (insurance for example) are typically the transactions with the longest frequency. So, with a rolling 12-month forecast, you won’t miss anything. And you can’t afford to.

What is the difference between a cash flow forecast and a cash flow statement?

Understanding the importance of a cash flow forecast and statement when managing cash is essential. A cash flow statement is essentially an overview of your current financial situation, while forecasting looks ahead into future performance. Both are necessary for understanding where you stand with regard to resources available in terms of money. To properly handle any business’s finances, it is critical that both these methods be utilised effectively together so no useful information is lost during decision-making processes around spending and receiving money or other sources associated with budgeting overall.

How do you forecast direct cash flow?

To forecast direct cash flow, you can use a relatively simple process of subtracting cash payments from cash receipts. This helps gauge short-term liquidity for specific points in the future. Using accounting software or spreadsheeting tools to record transactions and due dates and then sum the inflows and outflows for the total cash balance is important.

What is cash flow forecasting, and why is it important?

Cash flow forecasting is an essential and necessary tool for any business as it can provide key information on whether or not there are enough funds available and enable proper preparations in advance if cash outflows overtake inflows.