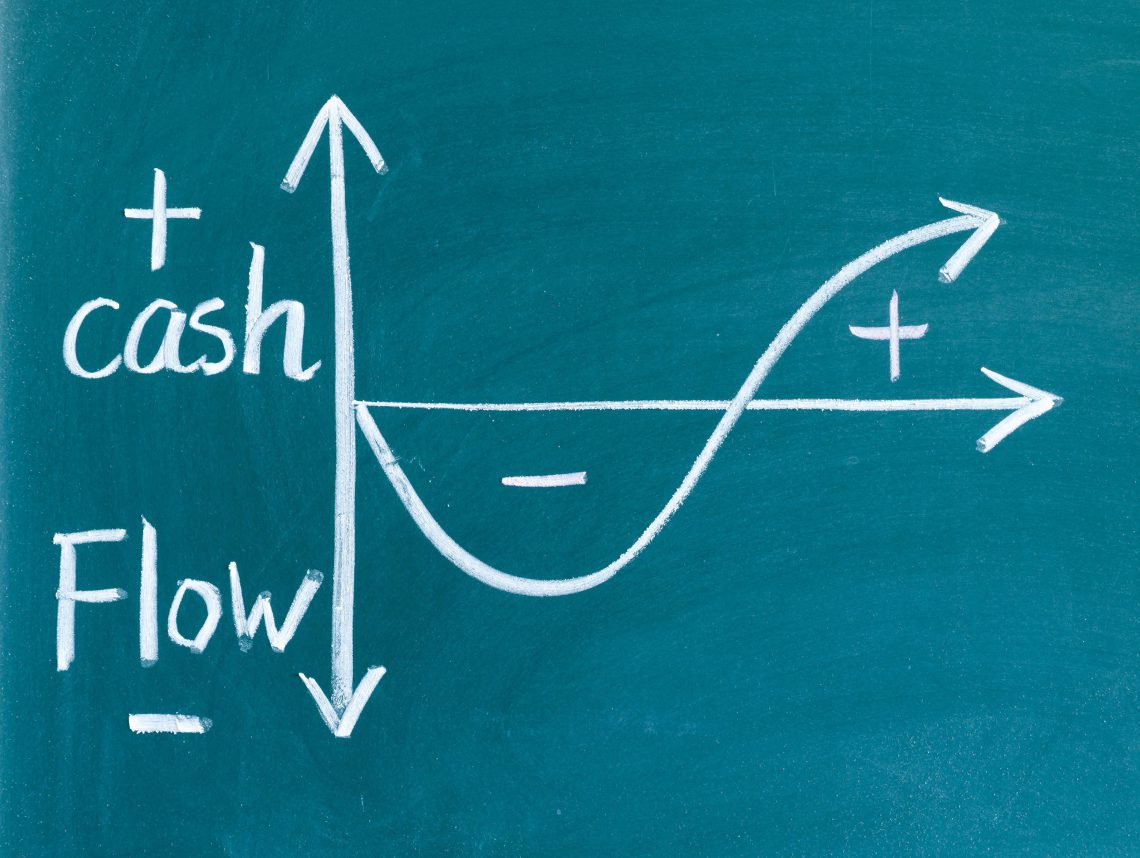

It’s a recurring theme on the Cash Flow Mapper blog: the world is not static, which means your cash flow is a constantly moving beast. And it is one which you have to understand and control as best you can. This means you must consider alternative futures with your cash flow planning, as well as keep tabs on cash movements as often as possible, ideally daily.

- Scenarios

Market turbulence means that if you have one cash flow plan, no matter how much experience, thought, and understanding has gone into it, it is not good enough from a planning and control perspective. Sure, you can have your expected case, which is where you meticulously plan everything assuming time-honoured behaviours and transactions. But how can you be sure that this will play out?

You can’t be sure! Good cash flow forecasting dictates that you prepare scenarios – “what-if” situations. Realistic ones of course! If it’s feasible that some inflows or outflows will change in volume, timing, frequency, then you need to see what this looks like, and consider what the consequences could be if these scenarios play out. And consequences can be positive or negative too.

- Rolling Plans

Having a rolling cash flow plan – one that refreshes itself every time you open it – is a good cash flow planning habit to have at the best of times, but in times of high uncertainty, it becomes even more important. A lot of businesses start doing rolling plans only when their cash flow situation has become diabolical; they know they need to monitor it closely and account for every change – receipt delays, supplier demands – on an ongoing basis. If they had been doing this from day one, then maybe they could have foreseen and might have avoided the trouble they now find themselves in.

The rolling cash flow plan has all your planned cash movements mapped out. When you open the model, you enter today’s cash balance, edit it with any changes you know have occurred since you last looked at your plan, and the model automatically updates. This is the ultimate in cash flow control tools, and you seriously need to consider introducing it into your business if you haven’t already.