Introduction

This paper is the second in a series of four that looks at a common sense approach to cash flow planning. The previous paper The comfort level of cash – we all have one, but what is yours? looked in detail at the first and second elements – using short-term cash flows (Element 1) to determine the comfort level of cash (Element 2) that is right for your business. That’s the amount of cash you need in your business at all times so that you are comfortable that the short-term needs are met.

Behaviours of Transactions

The next three elements are concerned with understanding the behaviours of transactions. These are simple to understand, but a lot of businesses ignore these when producing cash flow forecasts. The consequence of this is that the forecast lacks the detail needed for an accurate forecast and can result in wrong decisions being made – or even a business running out of cash in extreme cases. We’ll spend some time outlining these elements, as they are often ignored in cash flow planning due to the fact that a lot of cash flow plans are derived from budgeted profit and loss statements. Whilst this is a good place to start, rarely is the information in a format that can give you an accurate enough cash flow forecast for daily or even weekly usage. This is because the budgeted profit and loss statements:

- Are prepared for a financial year only, and the most details they show are activities per calendar month.

- Exclude non-profit and loss items, in particular cash flows relating to long-term elements – see Element 6 below. These must be included – if it’s cash, it belongs in your cash flow plan.

- They contain non-cash items such as depreciation and leave accruals. If you transpose these to your cash flow plan, you’ll be overstating outflows.

Let’s examine the behaviours.

Element 3- Frequency

All transactions have a frequency – how often they occur – and your cash flow plan needs to accurately reflect this. They were discussed briefly in our previous paper The comfort level of cash – we all have one, but what is yours?

As an example, you may have an advertising campaign whereby you have online ads on various sites for the entire financial year. Given that the campaign covers the whole year equally, it is correct to apportion the expense equally across all months (or even weeks if you like) when discussing profit and loss. However, if you are paying for that campaign in 4 quarterly instalments upfront, then it is these 4 cash outflows that must be reflected in your cash flow plan, not the averaged-out monthly expense.

So, while you may start with your profit and loss items, you must identify the frequencies with which your transactions actually occur in order to produce an accurate cash flow plan.

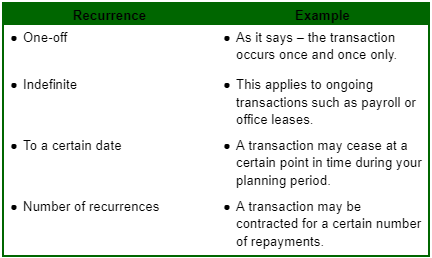

Element 4 – Recurrence

Recurrences modify frequencies and are straightforward enough. Not all transactions occur endlessly on a given frequency. You need to ensure that your transactions are forecast with these in mind. Going back to our discussion above, where the profit and loss statement is often used as a basis for the cash flow forecast, if you take annual numbers for transactions and then apportion them equally across each month (the correct treatment for accounting purposes), extrapolating this to mean cash flow movements may not be correct. The following table lists the recurrence types you need to consider when creating your cash flow plan.

Other things to consider are:

- Start & end dates of transactions where transactions may not span the entirety of your forecasting period. You may have a 48-month lease that finishes in three months’ time – your forecast needs to reflect this.

- Inflation factors to be applied periodically, often annually. Property leases are a common transaction where this occurs.

Element 5 – Timing

Even after taking into consideration frequencies and recurrences, one element can still throw your cash flow plan out, and that is the potential timing of cash movements. This particularly applies to cash inflows from customers. Whilst you may have a good understanding of the payment behaviour of a lot of your customers, from time to time, their buying and or payment behaviour may change. This can be due to seasonality within their business or other issues which result in changes to the cash inflows you receive from them, and when you receive the cash. Also, when factoring in new customers, you can never be certain as to their payment behaviour, despite assurances from them and what credit reports say. To this end,

- Timing of transactions is crucial.

- Ensure you know the impacts of various scenarios, particularly of differing customer payment behaviour and variable costs.

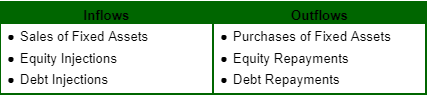

Element 6 – Transactions – Long Term

Up until now, we’ve concentrated on short-term transactions and their behaviours, the first five elements of cash flow planning. Once we understand these, and how they impact our business, we’ll then be in a position to understand how long-term transactions will be used in the business. These are transactions that involve time spans of greater than 12 months (compared to those we looked at in Element 1 in The comfort level of cash – we all have one, but what is yours?), and involve items per this table.

Thus, the overall impact of your short-term cash flows impacts:

- Your requirement to sell assets, take on loans or equity – long-term inflows, or

- Your ability to service loans, pay dividends, purchase assets / expand – long-term outflows.

Next…

The next paper in this series, An Approach to Planning & Forecasting Cash Flow, discusses taking the six elements and using them to produce the cash flow plans and forecasts that your business needs. While some businesses can get away with producing and working with one plan (and this is a perfectly fine method for a lot of businesses, providing that this plan does what you need it to do), circumstances may dictate that you may need more than one. Let’s find out soon enough!

Finally, Cash Flow, Comfort Level of Cash & Profit discusses the important distinction between cash and profit and why you need to understand this in the context of your comfort level of cash.

In case you missed it, or need to review it, the first paper in the series, The comfort level of cash–we all have one, but what is yours?, is available.

CashFlowMapper is a cloud-based cashflow forecasting tool designed so you can understand and take control of your most important asset – cash!

Ideal for advisors, business owners, or finance professionals.