Every business has recurring expenditures, from weekly or fortnightly payroll, through to monthly suppliers, and annual insurances. The point here is that, we all have to deal with and manage what are generally speaking fixed cash outflows – outflows that are incurred irrespective of the cash inflows our revenue channels generate.

Understanding these fixed outflows helps you work out the inflows you need to cover them. It’s similar to doing a break-even profit analysis, but there’s a difference.

While you may be able to work out the average revenue required to cover fixed costs and associated variable costs, this average calculation assumes that everything happens in a smooth linear fashion; there’s no allowance for the fact that your fixed costs actually fluctuate in amount over a cycle.

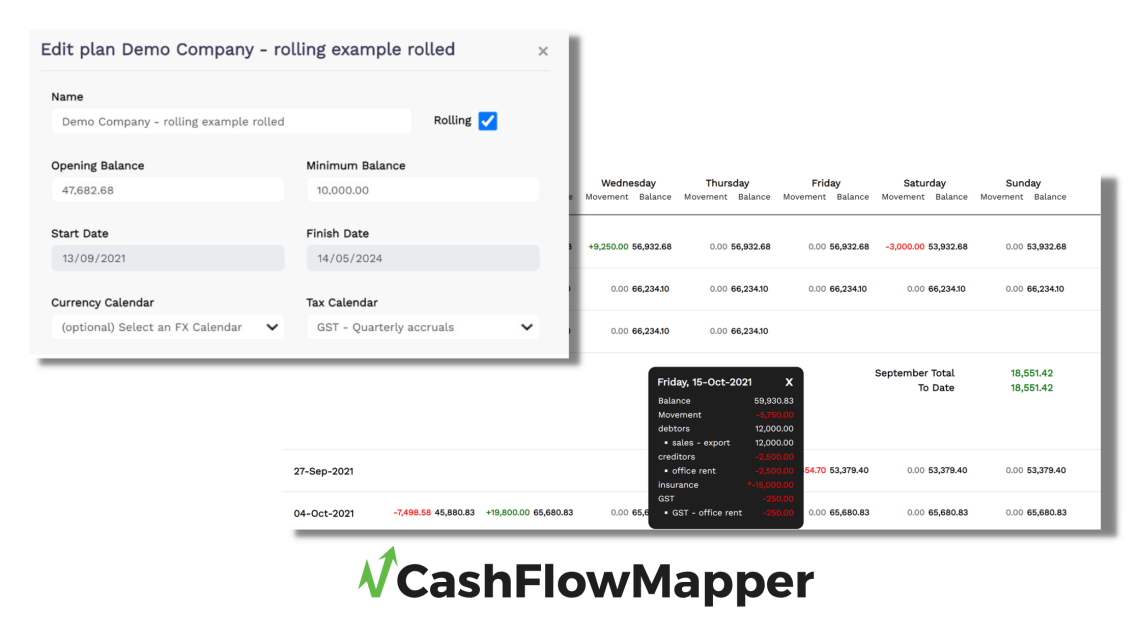

For example, net payroll may happen every fortnight, but annual insurance certainly doesn’t – you need to know the cash needed to cover that time of year when the insurance premium is due. This is where the power of Cash Flow Mapper’s rolling forecast feature comes to the fore.

-

Start with what you know

You probably know when almost all of your fixed costs occur, and if you don’t, you can easily find this out. This is your starting point. Map these transactions on your plan, and you know straight away what costs you have to cover and when. By using this information as a base, you can create scenarios around various inflow and variable outflow assumptions.

-

Keep a copy of your original plans, and work with rolling ones

We recommend keeping static versions of these scenarios, then copying them and making the copies rolling plans. It’s these versions that you’ll work with daily, weekly, or however often you analyse your cash flow. You will avoid the risk of large outflows “sneaking up” on you, because you’ll see them get closer and closer as you view them on the graph. And having taken the time to gather together all your fixed cash outflows, peace of mind comes with knowing that you haven’t missed anything. Of course, where there are any changes to transactions, CashFlowMapper allows you to edit the plan at any time – the software is as flexible as you need it to be.

-

Good habits make for good business decisions

As viewing your rolling forecast in CashFlowMapper becomes a habit, you’ll not only know when to take action to cater for upcoming large outflows, but also foresee when you have large surpluses on the horizon, and take full advantage of those – the most enjoyable part of cash flow forecasting!